Tax Talk | Here's your handy Tax Planning Checklist for 31 March 2026

With 31 March approaching, it is the ideal time to consider tax issues and also planning opportunities...

Time to read: 9 mins

In August 2018, cryptocurrencies exceeded US$212 billion in market capitalisation. At present, there are over 1,800 cryptocurrencies. There is significant volatility in the market in the six months from January to June 2018, market capitalisation has decreased by US$365 billion which equates to US$2 billion per day. Bitcoin is the most welknown and accounts for over 50% of the market capitalisation of cryptocurrencies.

Cryptocurrencies may prove valuable to those in developing countries without access to stable financial systems and have the potential to provide greater supply chain integrity by using Blockchain encryption. However, without a central regulatory system, cryptocurrencies may be manipulated to traffic illegal drugs or approve fraudulent transaction.

A cryptocurrency is a digital or virtual currency that uses cryptography for security. A cryptocurrency is difficult to counterfeit because of this security feature. Cryptocurrencies are organic in nature; they are not issued by any central authority, rendering them theoretically immune to government regulation

Accounting for cryptocurrencies is complex. Considerations include whether cryptocurrencies meet the definition of an intangible asset and whether they should be measured at cost or fair value.

At this stage, a universal accounting policy is unlikely given the varying uses of cryptocurrencies and the blockchain technology that underlies these. Some, but not all, can be used as a medium of exchange. For example, Democracy Earth, a nonprofit, has designed an app to enable voting using blockchain technology in order to eliminate or minimise electoral fraud.

“The blockchain is incorruptible; no one can modify or subvert how the votes are stored, and that’s vital for democracy.” Santiago Siri, Democracy Earth’s co-founder.

The definition of an asset in the IASB’s Conceptual Framework is: “A present economic resource controlled by the entity as a result of past events.”

An economic resource is defined as “a right that has the potential to produce economic benefits.” Would cryptocurrencies meet this definition? We think the answer to this is “yes”.

Assuming cryptocurrencies meet the definition of an asset, the following standards provide guidance to address items with characteristics of cryptocurrencies:

1. Cash (IAS 7 Statement of Cash Flows; IFRS 9 Financial Instruments)

2. Non-cash financial assets (IAS 32 Financial Instruments: Presentation, IFRS 9 Financial Instruments)

3. Investment properties (IAS 40 Investment Property)

4. Intangible assets (IAS 38 Intangible Assets)

5. Inventory (IAS 2 Inventories)

Exploring the intangible assets argument further, International Accounting Standard (IAS) 38.8 defines intangible assets as “an identifiable non-monetary asset without physical substance.”

It is likely that cryptocurrencies would meet this definition as well. Cryptocurrencies are identifiable (these can be sold, exchanged or transferred individually); are not cash and have no physical form.

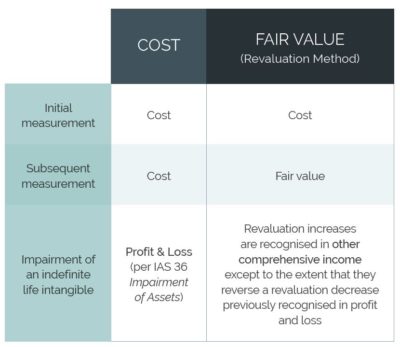

Given there is no expiry date on cryptocurrencies, cryptocurrencies would generally qualify as indefinite life intangibles. The following table helps illustrate how cryptocurrencies would be valued using existing accounting standards:

The revaluation method can only be used if there is an active market for the cryptocurrency. An active market is considered to be a “market in which transactions for the asset or liability take place with sufficient frequency and volume to provide pricing information on an ongoing basis.” (IFRS 13 Fair Value Measurement Appendix A)

An entity wishing to use the revaluation method will need to confirm that an active market exists for the cryptocurrency. If there is an active market for the cryptocurrency and if the revaluation method is elected as a policy, the statement of financial position would then reflect the fair value of the cryptocurrency at the end of the financial period, rather than what it cost to purchase.

IAS 38 does not apply to intangible assets held for sale in the normal course of business. Such intangible assets should be accounted for in accordance with IAS 2 Inventories. Inventories are measured by the lower of cost and net realisable value. As a result, decreases in net realisable value would be recorded in the statement of profit or loss while increases in net realisable value in excess of previously recorded decreases would not be recorded.

Commodity traders are considered to be “those who buy or sell commodities for others or on their own account, for the purpose of selling in the near future and generating a profit from fluctuations in price.” (IAS 2.5)

Commodity traders (also referred to as broker-traders) measure inventories of commodities at fair value less the costs to sell and record changes in value through the statement of profit or loss (IAS 2.3(b)). While this accounting result will seem logical to many, it is available only to those entities that meet the definition of a broker or trader.

It depends. You should follow the disclosure requirements of the standard used to account for the cryptocurrency (i.e. IAS 38 Intangibles, IAS 2 Inventories or IFRS 13 Fair Value Measurement). The following disclosures may also be relevant:

In addition to the accounting requirements, there may be securities regulation requirements that need to be considered.

t’s been a wild ride for cryptocurrency investors. At it’s peak in early 2018, the market cap for all cryptocurrencies was on track to break the US$1 trillion barrier by the end of this year. Only 8 months since it’s peak, the market cap is languishing at the US$200 billion mark, with US$12 billion alone wiped off the total in 1 hour in early September 2018.

Defining cryptocurrencies within existing IFRSs fits like the woolen jumper your grandmother knitted you a decade ago, but don’t despair, guidance is on the way. At the International Accounting Standards Board (IASB)’s January 2018 meeting, the IASB discussed initiating a research project on cryptocurrencies.

No. Thankfully accounting and tax agree! If treated like foreign currency, gains or losses under the financial arrangement rules would potentially be taxed on an unrealised basis, when coins are revalued back to NZD at the end of each income year.

Inland Revenue have outlined their view that cryptocurrency should be treated as property and not like foreign currency. This is consistent with Australia and the US where cryptocurrencies are designated as an asset for tax purposes.

Cryptocurrency has been compared to gold bullion from a tax point of view. Like gold bullion, there is no opportunity to derive income from cryptocurrency unless they are sold.

If a person acquires property for the purpose of disposing of it, then any amount they derive from that disposal is taxable income. Inland Revenue’s recent guidelines, which set out when proceeds from the sale of gold bullion count as income, may be used for further guidance. This notes very limited circumstances when buying and selling gold (or cryptocurrencies) may not be taxable.

Given the nature of assets like gold bullion and cryptocurrency, it will be hard to argue that the cryptocurrency is acquired without the purpose of disposal.

Contrast this with a share investment, where the dominant goal might be to derive dividend income. Ultimately the tax treatment will depend on the individual’s specific facts and circumstances for acquiring cryptocurrencies.

The good news is if a cryptocurrency meets the definition of an intangible asset and is fair valued through OCI, the timing of the tax and accounting impacts on sale should ‘marry’ in the profit and loss.

Yes, cryptocurrency received as payment for goods or services is business income, which is seen as taxable. This is seen as a barter transaction and you’ll need to calculate the value of the cryptocurrency in NZD at the time it is received.

It depends on your purpose for acquiring the cryptocurrency. Cryptocurrency is considered property for income tax purposes. Where you acquire cryptocurrency for the purpose of disposal (selling or exchanging it) the proceeds you make from selling it are taxable. Bitcoin and similar cryptocurrencies generally don’t produce an income stream or provide any benefits, except when they’re sold or exchanged. This strongly suggests that cryptocurrencies are generally acquired with the purpose to sell or exchange them.

No. Any disposal that creates a realised gain or loss needs to be recorded at the time it occurs.

‘Disposal’ includes swapping one type of cryptocurrency for another or exchanging cryptocurrency for NZD or another fiat currency such as US dollars or Euros.

There’s potential for companies to earn incredible returns from cryptocurrencies, but there is also significant risk of volatility as market caps rise and fall spectacularly, imitation “altcoin” currencies are developed and ‘crypto-jacking’ brings the credibility of these currencies into question. What is undeniable, however, is that being able to navigate the complexity of digital currencies provides a potential opportunity for the right kind of business.

– Report by Nicola Hankinson and Matt Bonner

DISCLAIMER: No liability is assumed by Baker Tilly Staples Rodway for any losses suffered by any person relying directly or indirectly upon any article within this website. It is recommended that you consult your advisor before acting on this information.

Our website uses cookies to help understand and improve your experience. Please let us know if that’s okay by you.

Cookies help us understand how you use our website, so we can serve up the right information here and in our other marketing.